Moon Capital Management LLC increased its stake in AerCap Holdings (NYSE:AER) by 8.1% in the second quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 75,715 shares of the financial services provider’s stock after buying an additional 5,691 shares during the quarter. AerCap comprises approximately 4.4% of Moon Capital Management LLC’s holdings, making the stock its 6th largest holding. Moon Capital Management LLC’s holdings in AerCap were worth $4,100,000 at the end of the most recent reporting period.

Moon Capital Management LLC increased its stake in AerCap Holdings (NYSE:AER) by 8.1% in the second quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 75,715 shares of the financial services provider’s stock after buying an additional 5,691 shares during the quarter. AerCap comprises approximately 4.4% of Moon Capital Management LLC’s holdings, making the stock its 6th largest holding. Moon Capital Management LLC’s holdings in AerCap were worth $4,100,000 at the end of the most recent reporting period.

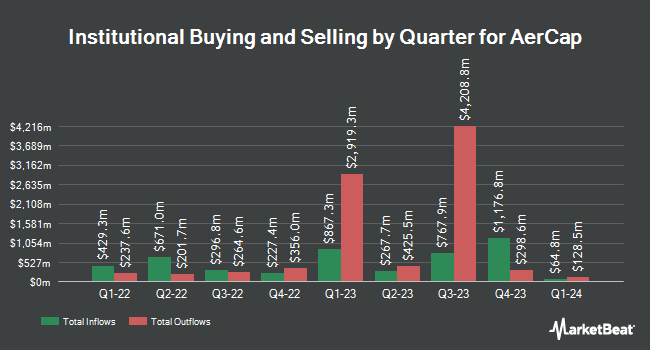

A number of other institutional investors and hedge funds also recently modified their holdings of AER. Schwab Charles Investment Management Inc. lifted its position in AerCap by 5.6% in the fourth quarter. Schwab Charles Investment Management Inc. now owns 68,122 shares of the financial services provider’s stock worth $3,584,000 after buying an additional 3,608 shares during the last quarter. AXA lifted its position in shares of AerCap by 96.0% during the fourth quarter. AXA now owns 17,420 shares of the financial services provider’s stock worth $917,000 after purchasing an additional 8,531 shares during the last quarter. Amundi Pioneer Asset Management Inc. bought a new stake in shares of AerCap during the fourth quarter worth $31,769,000. MML Investors Services LLC lifted its position in shares of AerCap by 43.8% during the fourth quarter. MML Investors Services LLC now owns 8,142 shares of the financial services provider’s stock worth $428,000 after purchasing an additional 2,479 shares during the last quarter. Finally, Caisse DE Depot ET Placement DU Quebec lifted its position in shares of AerCap by 91.0% during the fourth quarter. Caisse DE Depot ET Placement DU Quebec now owns 94,199 shares of the financial services provider’s stock worth $4,956,000 after purchasing an additional 44,878 shares during the last quarter. Institutional investors own 83.59% of the company’s stock.

Get AerCap alerts:

Several analysts have recently weighed in on AER shares. Zacks Investment Research upgraded AerCap from a “hold” rating to a “buy” rating and set a $62.00 target price for the company in a research report on Monday, May 28th. Morgan Stanley lifted their target price on AerCap from $49.00 to $52.00 and gave the stock an “underweight” rating in a research report on Thursday, April 12th. Cowen reiterated an “outperform” rating and set a $60.00 target price (up from $58.00) on shares of AerCap in a research report on Friday, May 4th. ValuEngine downgraded AerCap from a “strong-buy” rating to a “buy” rating in a research report on Wednesday, May 2nd. Finally, Deutsche Bank lifted their target price on AerCap from $68.00 to $71.00 and gave the stock a “buy” rating in a research report on Friday, May 4th. One research analyst has rated the stock with a sell rating, three have given a hold rating and eight have issued a buy rating to the stock. AerCap currently has a consensus rating of “Buy” and an average target price of $61.44.

Shares of AerCap stock traded up $0.61 during trading on Monday, hitting $55.20. 77,861 shares of the stock traded hands, compared to its average volume of 875,255. The firm has a market cap of $8.63 billion, a P/E ratio of 8.67, a P/E/G ratio of 0.71 and a beta of 1.82. The company has a current ratio of 0.60, a quick ratio of 0.60 and a debt-to-equity ratio of 3.34. AerCap Holdings has a 52-week low of $46.53 and a 52-week high of $56.26.

AerCap (NYSE:AER) last announced its quarterly earnings results on Thursday, May 3rd. The financial services provider reported $1.72 EPS for the quarter, beating the consensus estimate of $1.54 by $0.18. The firm had revenue of $1.22 billion for the quarter, compared to analyst estimates of $1.22 billion. AerCap had a return on equity of 12.54% and a net margin of 21.52%. The business’s revenue for the quarter was down 1.4% on a year-over-year basis. During the same quarter last year, the firm posted $1.48 earnings per share. analysts forecast that AerCap Holdings will post 6.42 earnings per share for the current year.

AerCap Company Profile

AerCap Holdings N.V., an aircraft leasing company, engages in the lease, financing, sale, and management of commercial aircraft and engines in Mainland China, Hong Kong, Macau, the United States, Ireland, and internationally. The company provides aircraft asset management services, including remarketing aircraft; collecting rental and maintenance rent payments, monitoring aircraft maintenance, monitoring and enforcing contract compliance, and accepting delivery and redelivery of aircraft; and conducting ongoing lessee financial performance reviews.

Want to see what other hedge funds are holding AER? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for AerCap Holdings (NYSE:AER).

Media headlines about Western Asset High Income Fund II (NYSE:HIX) have trended positive on Friday, according to Accern. The research firm ranks the sentiment of news coverage by monitoring more than twenty million news and blog sources. Accern ranks coverage of public companies on a scale of negative one to positive one, with scores nearest to one being the most favorable. Western Asset High Income Fund II earned a news impact score of 0.47 on Accern’s scale. Accern also gave media coverage about the closed-end fund an impact score of 47.4194799460443 out of 100, indicating that recent news coverage is somewhat unlikely to have an impact on the company’s share price in the next several days.

Media headlines about Western Asset High Income Fund II (NYSE:HIX) have trended positive on Friday, according to Accern. The research firm ranks the sentiment of news coverage by monitoring more than twenty million news and blog sources. Accern ranks coverage of public companies on a scale of negative one to positive one, with scores nearest to one being the most favorable. Western Asset High Income Fund II earned a news impact score of 0.47 on Accern’s scale. Accern also gave media coverage about the closed-end fund an impact score of 47.4194799460443 out of 100, indicating that recent news coverage is somewhat unlikely to have an impact on the company’s share price in the next several days.

Eaton Vance Ohio Municipal Bond Fund (NYSEAMERICAN:EIO) declared a monthly dividend on Thursday, July 5th, Wall Street Journal reports. Investors of record on Tuesday, July 24th will be given a dividend of 0.0469 per share on Tuesday, July 31st. This represents a $0.56 annualized dividend and a yield of 4.87%. The ex-dividend date is Monday, July 23rd.

Eaton Vance Ohio Municipal Bond Fund (NYSEAMERICAN:EIO) declared a monthly dividend on Thursday, July 5th, Wall Street Journal reports. Investors of record on Tuesday, July 24th will be given a dividend of 0.0469 per share on Tuesday, July 31st. This represents a $0.56 annualized dividend and a yield of 4.87%. The ex-dividend date is Monday, July 23rd.